Korea’s five budget carriers expected to boom this year, boosted by increase in thrifty travelers and strong local currency

|

|

Passengers on a flight run by budget carrier Jin Air pose with their portable electronic devices on March 1 after the airliner moved to allow passengers to keep their devices on during take-off and landing. (Yonhap) |

Kim Mi-yeon, 34, who works as a marketing manager for a major online shopping mall, started this week in anticipation of an upcoming weekend trip to Sapporo. This is her second trip overseas following a recent jaunt to Thailand in January.

“Cheap flights, provided by low-cost airlines, is why I’m able to travel so often,” Kim explained.

She spent just 200,000 won ($188) to purchase an airline ticket from T’way Airlines for the Sapporo trip. The ticket was almost half the price of Korean Air flights on the same route.

“If I can save money for another trip, I am willing to put up with the inconvenience of flying on a budget carrier, which typically features cramped seating and limited services,” Kim said.

Lifted by a fast-growing number of budget-conscious travelers like Kim, T’way Airlines ― re-branded in 2012 after a takeover deal with publishing company Yearim ― forecasts that it turned an operating profit last year for the first time in its nine-year history.

“With the turnaround of T’way Airlines, 2013 will be the first year that the country’s five low-cost carriers swing into the black,” LIG Investment & Securities said in a recent report, adding that it expects the upward trend to continue.

The five airliners are Jeju Air, Jin Air, Air Busan, Easter Jet and T’way.

They are also taking out a bigger bite of the overseas markets to gain on the top two domestic carriers, Korean Air and Asiana Airlines, both at home and abroad.

|

|

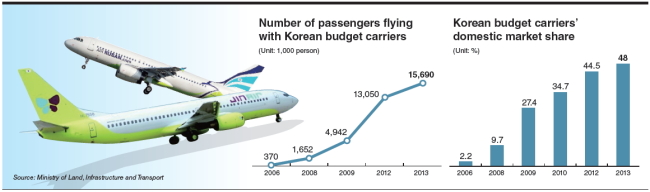

(Source: Ministry of Land, Infrastructure and Transport) |

According to the Ministry of Land, Infrastructure and Transport, the five low-budget carriers took up 48 percent of the domestic passenger market in 2013, up from 43.8 percent in 2012. Their share of the overseas passenger market also rose to 9.8 percent in 2013 from 7.5 percent.

Industry watchers said ticket sales for Jeju Air, Korea’s biggest low-budget carrier, are expected to have grown 32 percent to 450 billion won in 2013 on-year. Its operating profit is forecast to have jumped 430 percent to 23 billion won in 2013 over the same period.

Competition to heat up

Meanwhile, competition is expected to get fiercer as more foreign budget carriers seek to enter Korea.

“Competition for attracting more travelers, especially those who want to go overseas, will become heated as more multinational budget carriers seek to enter the local markets and contend against Korean carriers,” the LIG report said.

However, experts believe a strong Korean currency will help the local airlines maintain an upper hand against their foreign rivals.

The government is also offering support for the domestic carriers.

In an annual policy briefing to President Park Geun-hye last month, the Transport Ministry said it would support the growth of local low-cost carriers, which in turn would create more jobs and boost the competitiveness of the nation’s aviation industry.

For this aim, the ministry offered air freight business licenses to the local LCCs to support their business diversification early this year. In addition, it pledged to support the entry of local budget airliners into emerging economies in such regions as South America and Eastern Europe.

For long-term growth, however, industry watchers advised budget carriers to improve safety measures, risk management skills and service quality. The Korea Consumer Agency said it received 42 LCC-related consumer complaints last year, a 20 percent jump from 2012.

“Regarding safety matters, Jin Air, an affiliate of Korean Air, and Air Busan, the budget carrier arm of Asiana Airlines, operate a technical station for flight maintenance, repair and overhaul in Korea,” an official from the Korea Aerospace Industries said.

The three other carriers get the services from Japan or Singapore.

By Seo Jee-yeon (jyseo@heraldcorp.com)